Interfacing Workers' Compensation with Medicare: Essential Facts to Understand

Rolling with Workers' Comp and Medicare: How It Pans Out

With work injuries looming, it's essential to keep Medicare in the loop about any workers' compensation arrangements. Unless you do, you're potentially diving headfirst into claim denials and payments to reimburse Medicare.

Workers' comp serves as insurance for those who've suffered job-related injuries or illnesses. The Office of Workers' Compensation Programs (OWCP) falls under the Department of Labor and supports this benefit for federal employees, their families, and certain other entities.

If you're already enrolled in Medicare or soon will be, it's vital to understand how workers' comp settlements might impact Medicare's coverage of your medical claims. This will help you steer clear of medical costs quandaries for injuries or illnesses sustained at work.

How does a comp settlement shift things for Medicare?

The Medicare secondary payer policy kicks in here. Workers' compensation needs to cover any work-related injury treatment before Medicare steps in.

However, in case of immediate medical expenses cropping up before you receive your compensation settlement, Medicare might dip its toes in first. Medicare initiates a recovery process managed by the Benefits Coordination & Recovery Center (BCRC). This is to prevent complications with medical costs for work-related injuries or illnesses.

To keep things running smoothly, and to dodge a recovery process, the Centers for Medicare & Medicaid Services (CMS) keeps an eye on the amount a person receives from workers' comp for injury- or illness-related medical care. In some instances, Medicare may request a workers' compensation Medicare set-aside arrangement (WCMSA) for these funds. Medicare covers care only when the money in the WCMSA has been depleted.

What settlements need to be reported to Medicare?

Workers' comp is supposed to submit a Total Payment Obligation to the Claimant (TPOC) to CMS to ensure Medicare caters to the appropriate portion of a person's medical costs. This encompasses the total amount of workers' comp promised to the person or on their behalf.

The TPOC report is vital if you're already enrolled in Medicare because of your age or receiving Social Security Disability Insurance. It's also crucial if you're not in Medicare currently but will qualify within 30 months of the settlement date and the settlement is $250,000 or more. The same rule applies if you file a liability or no-fault insurance claim.

FAQs

You can get in touch with Medicare by calling 800-MEDICARE (800-633-4227, TTY 877-486-2048). During specific hours, you can also chat live on Medicare.gov. If you have questions regarding the Medicare recovery process, contact the BCRC at 855-798-2627 (TTY 855-797-2627).

A WCMSA is optional, but if you fancy arranging one, your workers' comp settlement should exceed $25,000 (or $250,000 within 30 months if you are soon to be eligible for Medicare).

Absolutely! It's prohibited to misuse WCMSA funds for purposes other than what they're designated for. Breaching this rule may lead to claim denials and reimbursement obligations to Medicare.

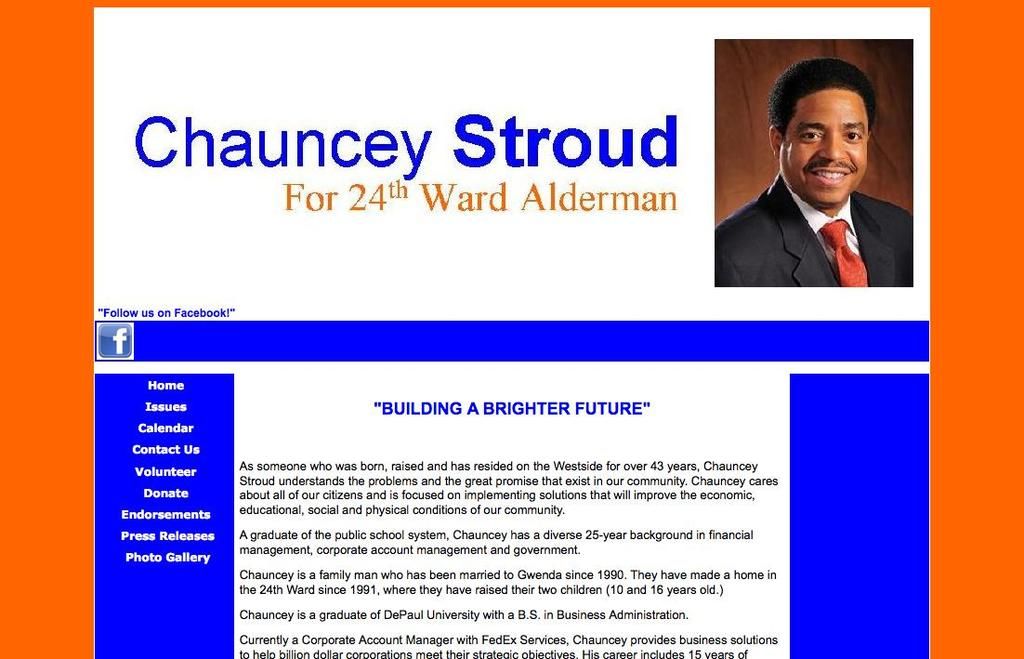

clinic-3A9uzS

Workers' compensation is insurance for post-work-related injuries or illnesses for federal employees and various groups.

It's crucial that Medicare subscribers or soon-to-be-subscribers educate themselves on how workers' comp may influence their Medicare coverage, avoiding issues with medical expenses.

Don't forget to inform Medicare about any workers' compensation arrangements to dodge future claim rejections and unwanted repayments to Medicare.

Resources for Medicare

For more helpful guides navigating the medical insurance maze, stop by our Medicare hub.

Health-and-wellness professionals should be aware that certain events, such as work injuries, can affect Medicare coverage for those already enrolled or soon to be enrolled.

To manage Medicare's coverage of medical claims for work-related injuries, it's essential to understand how workers' comp settlements might impact Medicare's secondary payer policy.

In the event of a workers' comp settlement, the Total Payment Obligation to the Claimant (TPOC) must be reported to Medicare to ensure proper coverage of medical costs. This report is crucial for individuals already enrolled in Medicare due to age or disability, as well as those who will become eligible within 30 months of the settlement date if the settlement exceeds $250,000.